-

info@skysavetrading.com

info@skysavetrading.com

Integrio deep industry expertise enables global brands to hit the ground running.

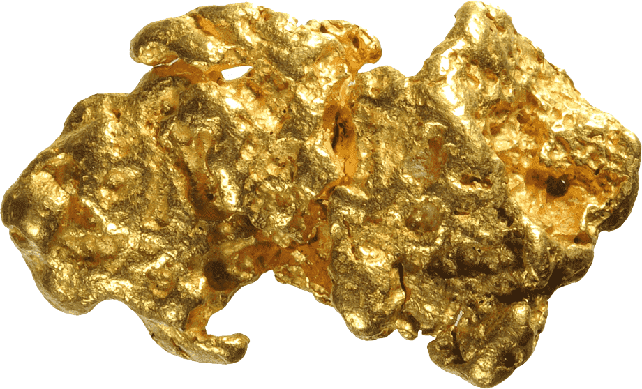

Gold is highly valued for its rarity, beauty, and use in jewelry, as well as its industrial applications in electronics and dentistry.

The process of gold mining typically involves several stages. Exploration is conducted to identify potential gold-rich areas, followed by the establishment of mining operations. These operations may involve open-pit mining or underground mining, depending on the location and accessibility of the gold deposits. Advanced technology and techniques, such as drilling, blasting, and extraction using heavy machinery, are employed to extract the ore-bearing rocks.

Once the ore is extracted, it undergoes further processing to separate the gold from other minerals and impurities. This process, known as gold refining, utilizes various methods such as gravity separation, flotation, and cyanidation. The refined gold is then transformed into bullion or other forms suitable for commercial use or investment purposes.

Real estate encompasses residential, commercial, and industrial properties, and it serves as a vehicle for both personal use and investment purposes.

Residential real estate involves properties intended for human habitation, such as houses, apartments, and condominiums. These properties are typically purchased for personal use or rental income, providing individuals with a place to live or serving as an investment that generates cash flow and potential appreciation over time.

Commercial real estate comprises properties used for business purposes, including office buildings, retail spaces, and warehouses. These properties are leased or sold to businesses and investors, facilitating commerce and economic activity. Commercial real estate investments can offer steady rental income and the potential for capital appreciation, making them attractive to investors seeking long-term returns.

dIndustrial real estate focuses on properties designed for manufacturing, warehousing, distribution, and research and development activities. These properties include factories, logistics centers, and specialized facilities. Industrial real estate investments can be lucrative due to the growing demand for industrial space driven by e-commerce, globalization, and supply chain management.dd

Cryptocurrency refers to digital or virtual currencies that utilize cryptography for secure financial transactions, control the creation of new units, and verify the transfer of assets. Unlike traditional fiat currencies issued by central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology. Bitcoin, created in 2009, was the first and most well-known cryptocurrency, and it paved the way for the development of thousands of other cryptocurrencies.

Cryptocurrencies offer several advantages over traditional financial systems. They enable fast and borderless transactions, reducing the need for intermediaries and lowering transaction costs. Cryptocurrencies also provide users with greater control over their funds, as they can be stored in digital wallets that individuals can manage directly. Additionally, the transparency and immutability of blockchain technology enhance security and reduce the risk of fraud or tampering.

The value of cryptocurrencies can be highly volatile, with prices subject to significant fluctuations. Speculation and market sentiment play a significant role in cryptocurrency valuations, and they can be influenced by factors such as regulatory developments, technological advancements, and market adoption. Cryptocurrencies have gained traction as an investment asset class, with many individuals and institutions considering them for diversification purposes or potential long-term growth.

The rise of cryptocurrencies has also led to the emergence of innovative applications and decentralized finance (DeFi) platforms. These platforms utilize smart contracts and blockchain technology to offer various financial services, such as lending, borrowing, and decentralized exchanges, without the need for traditional intermediaries. Cryptocurrencies and DeFi have the potential to disrupt traditional financial systems, offering greater accessibility, inclusivity, and financial sovereignty to individuals worldwide.

Forex, short for foreign exchange, refers to the global decentralized market where currencies are bought and sold. It is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily. Forex trading involves the simultaneous buying of one currency and selling of another, with the goal of profiting from fluctuations in exchange rates.

The forex market operates 24 hours a day, five days a week, allowing participants to engage in trading at any time. It is facilitated by a network of financial institutions, including banks, brokers, and electronic trading platforms. The main participants in forex trading are banks, multinational corporations, institutional investors, and individual traders.

Forex trading offers several advantages, including high liquidity, leverage, and the ability to profit in both rising and falling markets. Traders can take advantage of the volatility and price movements in currency pairs to generate profits. However, it is important to note that forex trading also carries risks, as exchange rates can be influenced by various factors such as economic indicators, geopolitical events, and market sentiment.

To participate in forex trading, traders use specialized platforms that provide access to real-time price quotes, charts, and tools for analysis. They employ various trading strategies, including technical analysis, fundamental analysis, and risk management techniques, to make informed trading decisions.